ESSER Planning

| Date: | August 11, 2022 |

|---|---|

| Subject: | Planning and Use of ESSER Funds |

| Category: | Information Update |

| Next Steps: | Share with CFO and finance staff |

This letter is meant to serve as a reminder of how federal pandemic relief funds presented to local educational agencies (LEAs) are one-time in nature but have flexibility to allow LEAs to plan an effective transition of support of their students. Taking advantage of this flexibility requires careful planning and budgeting to maximize the use of state, local, and federal dollars.

The one-time federal pandemic relief funds that provide this flexibility are:

- Elementary and Secondary School Emergency Relief Fund (ESSER) of the Coronavirus Aid, Relief, and Economic Security (CARES) Act (ESSER I, Fund 266)

- ESSER II of the Coronavirus Response and Relief Supplemental Appropriations (CRRSA) Act (ESSER II, Fund 281)

- ESSER III of the American Rescue Plan (ARP) Act of 2021 & Supplemental ESSER (ESSER-SUPP) (ESSER III, Funds 282 & 283)

Together, these ESSER grants allow for supplanting state and local expenditures provided that the following three criteria are met. The usage must:

- meet the intent of the ESSER grant;

- be an allowable activity of the grant; and

- be reasonable.

Each grant has allowable pre-award costs back to March 13, 2020, and expires on a rolling basis starting on September 30, 2022.

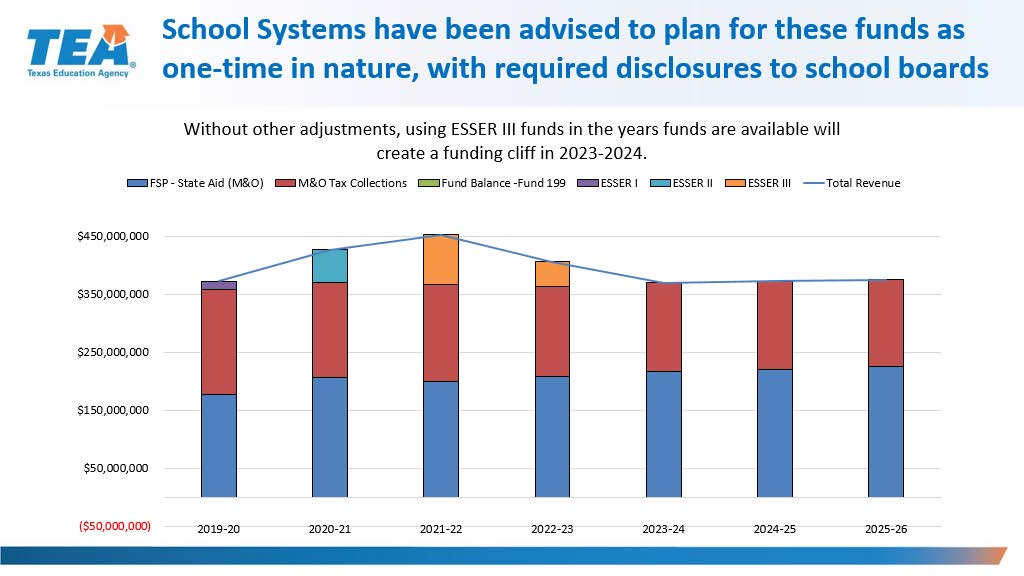

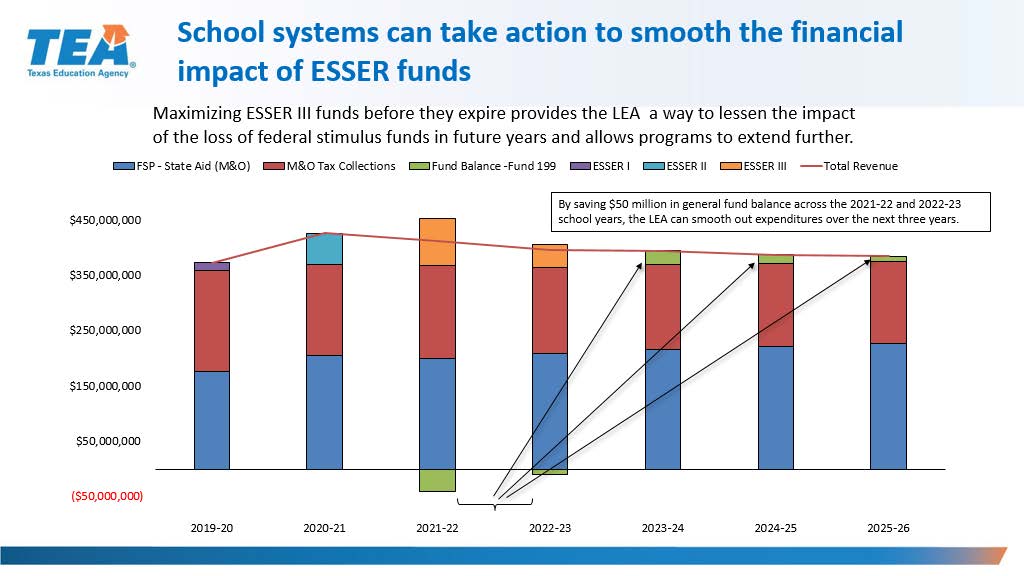

As of July 1, 2022, approximately $11.5 billion dollars of LEAs’ federal ESSER funds remained. TEA has previously communicated the nature of these as one-time funds, that could disrupt LEAs if they do not plan accordingly. TEA has provided training webinars on this topic previously, the content of which are summarized on the following slides that illustrate the potential impact and provide a strategy to lessen its impact.

Strategically planning for the use of ESSER funds and taking advantage of this unique opportunity is an option for each LEA to extend educational support to their students and ease the impact of the funding cliff when federal ESSER funds are no longer available.

Many LEAs are already aware of these issues, and already planning accordingly. But as a reminder, training on how to plan to minimize any negative fiscal disruption was previously provided by TEA, and can continue to be accessed. For more information, please visit the following links:

Budget Planning with ESSER Funds

- Budget Planning with ESSER Funds Recorded Webinar (Video)

- Budget Planning with ESSER Funds Deck (PDF)

If you have any questions, please don’t hesitate to reach out to: financialaccountability@tea.texas.gov or schoolaudits@tea.texas.gov .

David Marx, CPA

Director, Financial Compliance Division

School Finance Department